How Vendors Can Use Amazon Brand Analytics (Formerly Retail Analytics ARA Premium)

Patrick Quaggin-Smith, April 6, 2020

Amazon Brand Analytics (formerly known as Amazon Retail Analytics Premium, or ARAP) provides vendors with valuable information for operative and strategic decisions. Understanding how to use it is critical, however, it’s easy to lose sight of the important KPIs and metrics in the data jungle of Amazon Brand Analytics.

In this article, we aim to provide a comprehensive overview of how vendors can use Amazon Brand Analytics, and how they can convert insights into the right decisions. In particular, we also provide a step-by-step example of how you can action Amazon Brand Analytics reports to achieve specific goals.

If you're looking for some quick answers on the topic, read our FAQs section at the bottom of the page. There you will get a general explanation of some of the key metrics and data provided by Amazon Brand Analytics.

Introduction—What you should know about Amazon Brand Analytics

Here we will provide a quick overview of Amazon Brand Analytics, before taking a closer look at the individual reports and how you can use them.

Who needs which data? Key account managers, marketers, eCommerce analysts & agencies

The table summarizes some of the key roles that can benefit from Amazon Brand Analytics.

Role | Value of Amazon Brand Analytics |

|---|---|

Key account manager | Operational-level reports. Focus KPIs include: revenue, margins, inventory, returns and other costs. |

Marketer with responsibility for Amazon | Strategic-level reports with a focus on advertising KPIs such as: ROAS, attributed ad spend, impressions, click-through rate, conversion rate, visibility, share of voice. |

eCommerce analyst | Strategic look at consumer behavior. Competitor analysis, assessing market share in the relevant space. May also use share of voice metrics for portfolio analysis. |

Agency staffer | Mixture of operational and strategic concerns. Similar to marketer but also looking to maximize productivity across multiple clients (vendors). |

Terminology: ARA Basic vs. ARA Premium (ARAP) vs Brand Analytics

In the past, users of Vendor Central had access to a product called Amazon Retail Analytics (ARA), which existed in two forms: ARA Basic and ARA Premium. These have since been superseded by Amazon Brand Analytics, with Amazon not only simplifying their nomenclature, but switching to the same offering for all vendors.

This means that all users can now access the complete suite of reports, including:

Snapshot

Sales diagnostics

Geographic performance trends

Net PPM

Pre-orders

Traffic diagnosis

Real-time sales

Forecast and inventory planning

Inventory health

Amazon search terms

Repeat purchase behavior

Item comparison and alternate purchase behavior

Demographics

Customer reviews

Product catalog

Data availability

Scheduled email reports

As well as the reduced feature list, reports in the basic version of Amazon Retail Analytics used to only provide seven days of data, with ARA Premium offering a much more extensive history. With Amazon Brand Analytics, all users have access to all available data.

Amazon's decision to open up this ARA Premium data to all users means that all vendors now have the potential to gain powerful insights. However, effective use of Amazon Brand Analytics depends on how you can leverage the data.

Differences between Seller Central and Vendor Central

As Amazon Brand Analytics is accessed through the same portal that sellers and vendors use to manage their accounts i.e., Seller Central for sellers and Vendor Central for vendors. Seller central is self-service oriented but in Vendor Central you can interact directly with Amazon.

While Brand Analytics in Seller Central gives all users access to the same interface and the same data, this used to be different in Vendor Central. Before February 2020, vendors could choose whether to pay for the premium version of Amazon Retail Analytics (ARAP), or to use the stripped-down version (ARA Basic). Now, however, Amazon Brand Analytics in Vendor Central is also available to all vendors.

Amazon Brand Analytics Deepdive

The main aim of working with Amazon Brand Analytics is to analyze your sales performance. But this has several aspects to it. Here we run down the most important data sources Amazon Brand Analytics provides to help you with your operative and strategic decisions.

If you want to understand why your sales are currently increasing or plummeting, you have different metrics that you can look at, starting with traffic and conversions. Is there any traffic on your pages or are the conversions low? If your conversions are low, is it because your content isn’t that great? If so, then you can take steps to optimize your content. Or is it because of availability? Maybe your product isn’t in stock. If you are seeing a lot of returns, then why is that?

These are the kinds of questions you can answer if you know your way around your Amazon Brand Analytics in Vendor Central. When you are new to Amazon Brand Analytics, it can take some time to understand what is what, but we certainly recommend familiarizing yourself with the different metrics and naming conventions. and why they are named like this. We are going to see which metrics mean what.

Sales performance

Let's start with sales performance and sales metrics, where you can gain insight into how much you sell to Amazon, how much Amazon sells to customers, and how much other people sell of my brand.

The table shows the KPIs given in Amazon's sales diagnostics, and how they map to vendors' (common) internal KPIs.

Amazon KPI | Includes returned items | Calculation | Internal KPI |

|---|---|---|---|

Shipped Revenue | Includes returned items | Avg. Sales Price x Shipped Units | Sell-Out |

Ordered Revenue | Includes returned items | Avg. Sales Price x Ordered Units | Sell-Out (approximately) |

Shipped COGS | Includes returned items | COGS x Shipped Units | Sell-Out/Sell-In mix |

Net Received | Includes returned items | Net amount received by Amazon minus amount returned | Sell-In |

In the table, you should pay attention to the distinction between Ordered Revenue and Shipped Revenue. Ordered revenue is average sales price multiplied by ordered units, but it doesn't mean these units have been shipped yet. This is why most vendors use the shipped revenue as their sell-out KPI. What you want to have is your shipped units.

Besides the different metrics, you can also switch between a sourcing view and a manufacturing view. There is a wealth of options here, and the most useful for you will depend on what exactly you are interested in. Some vendors like to see the number of units sold by other sellers; others like to filter by distributor, category or brand.

Whatever your use case, it is likely there is sales information to be found in Amazon Brand Analytics—and if you can't find what you're looking for, your vendor manager may often be able to help.

Traffic and conversions

If you're looking at your sales diagnostics and you can see that your sell-out is going down, then you can then check why. One of the first places to look is traffic diagnostics. You can see how much traffic is on your PDP and how high your conversion rate is.

While the Vendor Central version of Brand Analytics doesn't provide absolute numbers of impressions and conversions, what you can see is the changes in glance views, conversions, and unique visitors. This is less useful than absolute values, but you can compare these changes with the percentage changes in your sales metrics and see if there is any correlation.

Rankings and optimization potential

A common cause of a drop in sell-out is a drop in conversion rates, which you can address by optimizing the content on your product detail pages (PDPs). Here, prioritization is key, particularly for larger vendors. Here, vendors take different approaches, with some prioritizing by revenue, others by units sold. More units sold will mean more visibility for your brand, even if these are lower-ticket products.

When optimizing, you might also want to think about seasonality—don’t wait until a week or two before the peak season starts because it takes time for Amazon's algorithm to pick up changes.

Besides the PDP content, you should also optimize any ads you have that (are intended to) drive traffic. Amazon Brand Analytics has Amazon search terms showing top search terms by Search Frequency Rank (SFR)—this is accurate, premium data that was previously only available in ARA Premium. It tells you the most-clicked ASIN, and the conversion and click shares of the top ASIN.

Many vendors also look to third-party tools to build out their keyword research. ARA Premium was said to have only 1.6 million keywords and there are tools available that boast far more. One simple method, whichever tool you're using, is to find a keyword, do a reverse ASIN lookup and then get all the keywords the top ASIN is ranking for. This is quick, effective research that can be a great starting point for your keyword optimization.

Don't forget that for some keywords, even if you have them in your listing, you need to check that you are in fact indexed for these keywords. Otherwise you won't be found for the right keywords and by the right customers. If you're lacking visibility for an important keyword, you can move it from the product description to another content element like the bullet-points where they will more likely be picked up and indexed.

Inventory, excess inventory, and forecasts

The next thing to look at is your availability. You can use the inventory health report to check:

which of your products are in stock;

where you have had recent orders;

if you have open purchase orders;

what your current stock levels;

how many units are sellable.

You should always prevent stock excess because having a lot of sellable inventory aged 90+ days can lead to Amazon lowering the price in an effort to sell out everything. This reduces Amazon’s margin and can crap out (Cannot Realize Any Profit) your product, which will likely result in Amazon deciding not to buy the product anymore.

To stop this happening, you can use inventory health data to identify products that have been in stock for a long time. Based on this data, you can set up/increase budget on your Sponsored Products campaigns to ensure that you sell your stock before Amazon cuts the price.

Purchase behavior, cross-selling, and up-selling

One advantage of Amazon Brand Analytics (and something that was also previously only available in the paid premium version of Amazon Retail Analytics) is that it sheds light on consumer behavior, providing data on how often your products are repeat purchased, how often your products are bought in combination with other products etc.

You can action this data, for example, by creating multipack deals for products that are frequently bought multiple times, or by utilizing Amazon Subscribe & Save to incentivize repeat purchases.

Market basket analysis can also reveal opportunities for bundles with complementary products. Or you can create PDA or ASIN-targeting campaigns to go after competitor products and attract more sales.

Returns

It’s always a good idea to analyze which products are being returned and why. Reactively, you can do this with the sales diagnostic report, where you have a metric called customer returns that will show you which products have been returned the most times.

More actively, you can conduct review management to find out if there are any clusters within your poor reviews and use these to identify product issues before the returns pile up. If you already see that a product has an issue that is causing frustration with many customers, then you can go back to product management and solve quality issues before they have too serious an impact on your business.

Amazon Brand Analytics in Action—How to Increase Your Market Share

Since its inception, vendors have used Amazon Retail Analytics Premium (and now Amazon Brand Analytics) to increase their market share. Climbing the Best Sellers Rank and leaping over your competitors in sales is the dream of any advertiser on Amazon—figuring out how to do so is the challenge.

The obvious means of achieving this goal is to undergo a conquesting strategy by bidding aggressively on your competitor's branded keywords and ASINs. Due to lower conversion rates on these targets, ACOS will inherently be very high, leading to a risk of spending a lot of money without any meaningful incremental total sales growth. Even worse, the only thing you learn from this search term data is that conquesting may not be the right strategy for you.

So, how do you climb Best Sellers Rank on Amazon without conquesting or spending recklessly?

At Perpetua, we use Brand Analytics to identify market share opportunities by looking at a competitor��’s high-volume, high-converting category keywords. Then, we leverage advanced tools in our product such as Keyword Boost to dominate top-of-search placements, measure organic rank to see the effectiveness of this strategy, and quickly displace competitors.

Market Share Domination Part 1: Understanding Brand Analytics

Determining your competitor’s high-volume, high-converting category keywords is arguably one of the most valuable applications of Amazon Brand Analytics. These reports store around two million of the most-searched keywords on Amazon, every day for the last year, and the top three organically ranked products for each keyword, with their associated click share and conversion share (both as a percentage).

Users can search this database either by keywords (displaying all associated phrase and broad match keywords) or by ASIN (displaying all keywords where that particular ASIN is in the top three). These can be filtered through daily, weekly, or monthly views.

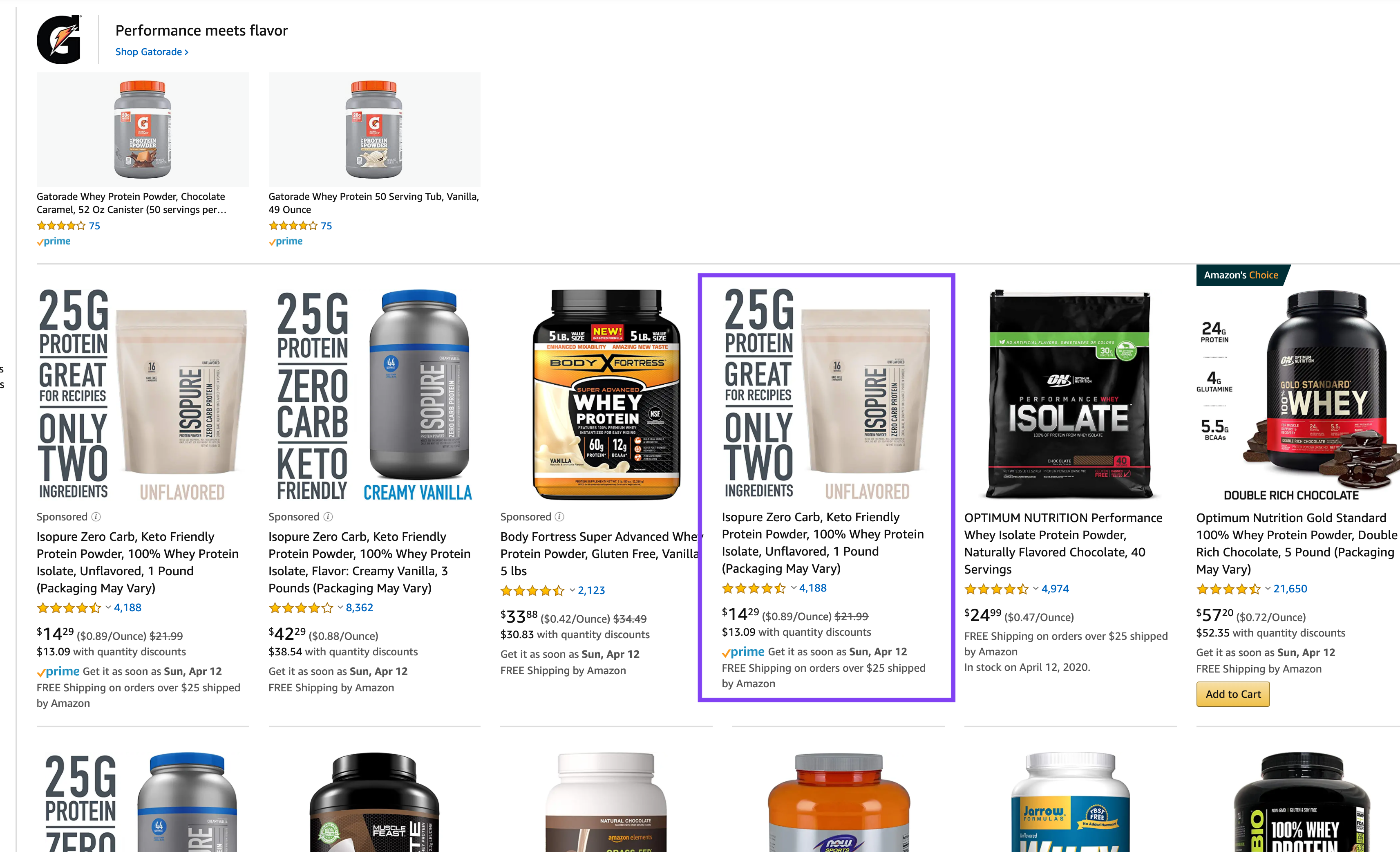

In the following example, we'll take the perspective of a supplements company, Isopure, who is hypothetically looking to grow market share on their top product: non-flavor whey protein isolate. At time of writing, Isopure is ranked #1 organically for the keyword whey protein isolate.

DISCLAIMER: We do not work with Isopure or this product (but we would love to!).

How to identify the most valuable keywords using Brand Analytics

Open the Amazon Brand Analytics (formerly Amazon Retail Analytics Premium) tab in AMS.

Search the term you are organically ranking number one for: Whey Protein Isolate

Identify a relevant keyword where a competitor (or multiple competitors) is ranking higher than you organically and copy their ASIN. In this case, the nearly identical word, isolate whey protein, has Dymatize ISO 100 (B006OC432E) ranked first.

Search a competitor ASIN that you just copied instead of the keyword originally searched in Brand Analytics. This will allow you to uncover all of the keywords where your competitor's product is ranked in the top three organically.

Analyze all competitor keywords where they are ranking in the top 3 and identify the non-branded, relevant keywords that have significant search volume where your brand is ranked lower than #1. At Perpetua, we usually define significant search volume being within the first 200,000 of searches.

After completing the search, you can identify the five keywords that are most relevant, have the highest search volume and are currently being won by your competitors. In our example, that's:

whey isolate

isolate whey protein

whey isolate protein

protein isolate

isolate protein powder

Market Share Domination Part 2: Using Keyword Boost to Dominate Top-of-Search, Climb Organic Rank, and Displace Competitors.

Winning even a percentage or two on these keywords will drive significant account growth and they will be the subjects for our experiment with the Keyword Boost feature on Perpetua. The keyword boost feature lets you increase the bids on these keywords while simultaneously directing a higher percentage (user-controlled) of spend towards the top-of-search placement, which is the most effective at increasing organic rank.

You can increase your bids and percentage of spend dedicated to the first three ad placements on any given keyword using a Keyword Boost multiplier in Perpetua. This is important as it artificially creates impressions (and hopefully conversions) on a keyword. The increase in engagement directly correlates to organic rank on a specific keyword faster than if you were to simply boost your bid for that keyword. Our data has shown that using the Keyword Boost multiplier is the most effective way to climb organic rank.

With the keyword boost experiments running, it is important to measure key metrics on the impacted campaign/product:

Attributed Sales

Organic Sales

ACOS

Total ACOS

Organic Keyword Rank

Results do not happen overnight, and it is important to allow these types of experiments to run for weeks, if not months. We recommend running experiments for a minimum of 2 weeks, but even better if you can run for at least 30 days. We are using a scientific, methodical approach. This means that the more data we can collect, the more informed our long-term Amazon advertising strategy will be.

Amazon Brand Analytics FAQ

What is the difference between ARA Basic and ARA Premium?

What's changed from ARA to Amazon Brand Analytics?

Should I choose ARA Basic or ARA Premium?

What is the difference between Shipped COGS and Net received?

What is the difference between sourcing and manufacturing view?

To get started or learn more about how Perpetua can help you scale your Amazon Advertising business